Coinbase Exchange Faq

What is Bitcoin Cash?

Bitcoin Cash (BCH) is a direct result of a Bitcoin fork that occurred on August 1, 2017. It is an alternative version of Bitcoin that makes use of new features and rules, and has a different development roadmap. For more information about Bitcoin Cash, please visit https://www.bitcoincash.org.

How do I get Bitcoin Cash on Coinbase?

Coinbase is also registered as a Money Services Business with FinCEN. Coinbase is required to comply with a number of financial services and consumer protection laws, including: The Bank Secrecy Act, which requires Coinbase to verify customer identities, maintain records of currency transactions for up to 5 years, and report certain transactions. Coinbase is one of the biggest cryptocurrency exchanges in the world with unparalleled trading volume and a long-standing reputation for industry-leading security. It’s simply one of the best ways to buy Bitcoin.

Coinbase customers have automatically been credited with the appropriate amount of Bitcoin Cash for their accounts. These funds appear within a separate Bitcoin Cash wallet on your Accounts page or in the Coinbase mobile apps.

Coinbase Exchange Faqs

You can also obtain additional Bitcoin Cash by purchasing it on Coinbase, or trading on Coinbase Pro.

How much Bitcoin Cash will I receive?

The amount of Bitcoin Cash you receive will be the amount of Bitcoin that was in your account at the time of the fork. The fork occurred on August 1, 2017 at 5:16:14 PST and on block #478558. Please note you will not receive Bitcoin Cash for any Bitcoin you removed from the platform before the fork, or purchased after the fork.

How can I trust that Coinbase knows the exact amount of Bitcoin Cash that was in my account at the time of the fork?

At the time of the fork, we duplicated the current balance of all Coinbase customer accounts. Customers can download a copy of their transaction history to see a running log of their balance for each Bitcoin wallet.

If I had a pending BTC purchase at the time of the fork, will I still receive BCH for that purchase?

No. To be credited with BCH, the corresponding bitcoin must have been present in your account at the time of the fork on August 1st, 2017, block #478558. If you had a pending purchase that completed after this time, you will not receive BCH for that purchase.

If my Bitcoin was in my Coinbase Vault at the time of the fork, will I still receive my BCH?

Yes, you will still receive your Bitcoin Cash funds. All BCH will be credited to a single BCH wallet in your Coinbase account.

What if I sent BCH to my Coinbase BTC wallet after the fork, but before Coinbase added support for Bitcoin Cash?

Any BCH sent to your Coinbase account addresses has been credited to your new BCH wallet.

I sent my funds off of Coinbase before the fork. Will I still get my BCH?

No. If you sent Bitcoin off of Coinbase before the fork, you will not receive Bitcoin Cash from Coinbase. If you sent to another exchange and did not receive your BCH, please contact their support team.

Can I send BCH to Coinbase?

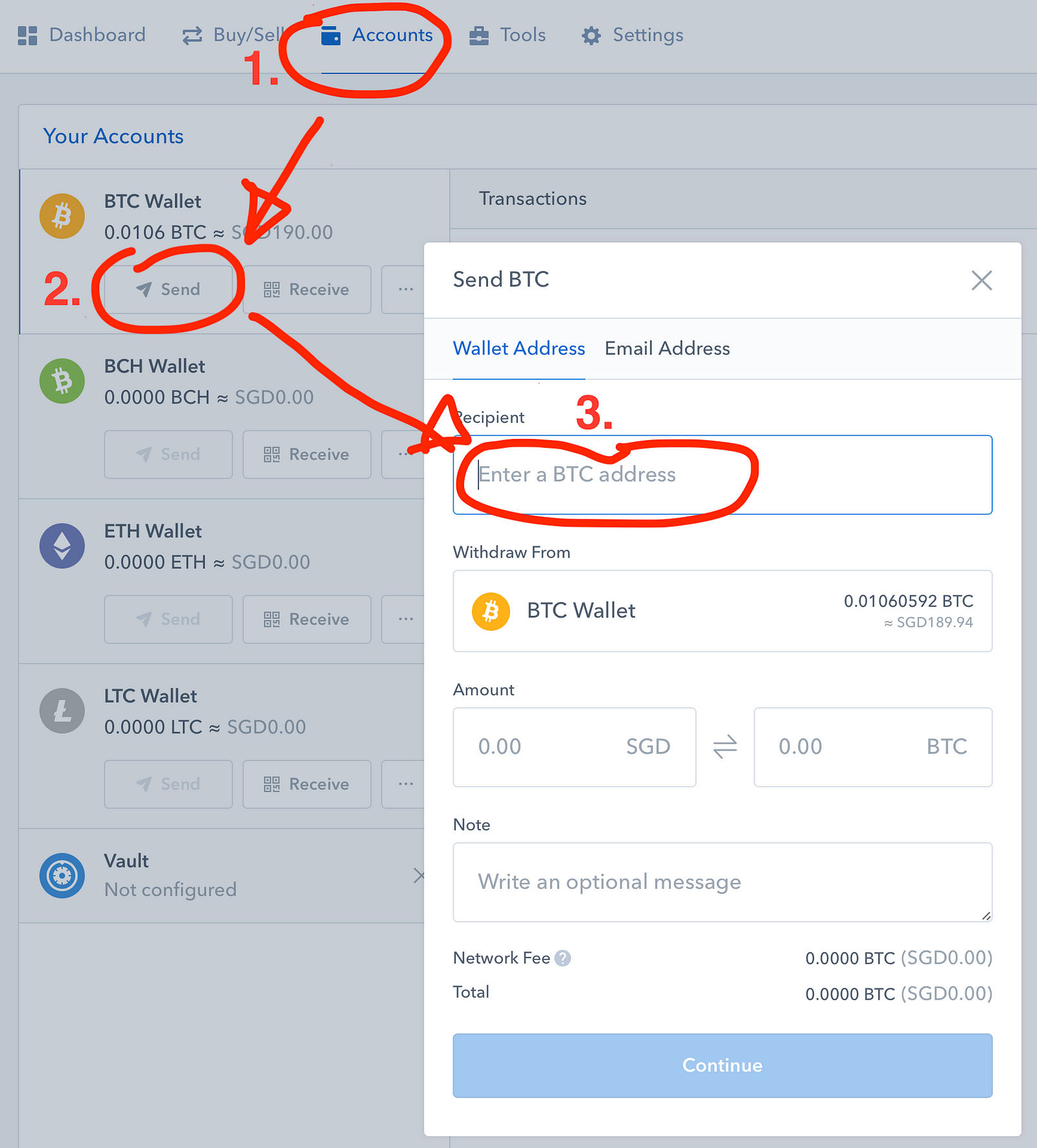

You can send BCH to and from Coinbase the same way you send all other assets on the platform. You can select the 'Deposit' button next to your BCH wallet to view your BCH deposit address.

What happens if I send Bitcoin Cash to a Bitcoin address?

At this time, Coinbase has already credited accounts who received any BCH at their existing BTC addresses. Going forward, we cannot guarantee that funds will be properly credited when one asset is sent to the address of a different asset. Please make sure that you only send funds to the specific deposit address displayed in your Coinbase account for the asset you are sending. You can view a list of these addresses, or create a new one, by visiting this page.

If you have sent BCH to an external address that was used only for BTC, you will need to obtain the private keys for that address and import them into a BCH wallet in order to access the funds stored there. Coinbase does not support the importing of private keys.

Previous Announcement: As of December 19, 2017 Coinbase will add Bitcoin Cash to our assets. Coinbase customers in qualifying countries will now be able to buy, sell, send and receive Bitcoin Cash.

Update: The European markets were not sufficiently healthy to enable Coinbase customers to buy and sell Bitcoin Cash. We anticipate enabling buys and sells for European customers in early January 2018.

For the 2020 US tax season, Coinbase will issue the IRS Form 1099-MISC for rewards and/or fees through Coinbase.com, Coinbase Pro, and Coinbase Prime.

Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations.

What are my crypto tax obligations for the 2020 tax year?

If you have sold or converted crypto in the year 2020 and are subject to US taxes, you are required to report your gains/losses to the IRS.

To learn more about how US taxes and crypto work, please visit: http://coinbase.com/bitcoin-taxes.

Where can I download my transaction history?

You can download your transaction history in the reports tab for your Coinbase.com transactions and the statements section of Pro to download Pro transactions.

To calculate your gains/losses for the year and to establish a cost basis for your transactions, we recommend connecting your account to CoinTracker. Click here for more information.

1099-MISC for rewards and/or fees

You may receive a 1099-MISC if:

- You are a Coinbase customer AND

- You are a US person for tax purposes AND

- You have earned $600 or more in rewards or fees from Coinbase Earn, USDC Rewards, and/or Staking in 2020.

Does Coinbase provide 1099-Ks?

As of the 2020 tax year, we will not be issuing Form 1099-Ks for trades on Coinbase.

Does Coinbase provide 1099-Bs?

We do not issue Form 1099-Bs.

International Customers

At this time, we do not provide tax forms for international customers. Please utilize your transaction history to fulfil any local tax filing obligations.

What is a B-Notice and why did I receive one from the IRS?

You may receive an IRS B-Notice if there are any discrepancies with your tax identification number (TIN) and legal name used by Coinbase to file Forms 1099 with the IRS. The B-Notice will:

Prescribe what information is needed to resolve the B-Notice

Inform you if you are required to provide any additional information beyond updating or correcting your name or TIN

To correct your TIN and/or name, please contact Coinbase Support. For more information about the IRS B-Notice, please go here.

Are my crypto donations tax deductible?

Charitable contributions of cryptocurrency may be tax deductible. Please consult your tax advisor regarding your personal tax circumstances.

Where can I donate cryptocurrency?

Coinbase Exchange Faq Calculator

GiveCrypto is a nonprofit that distributes cryptocurrency to people living in poverty by connecting them to an open financial system.